A range of tools for assignors and investors

Groupe GTI implements its financing technique by reserving it for strict matches between real assets

and investments.

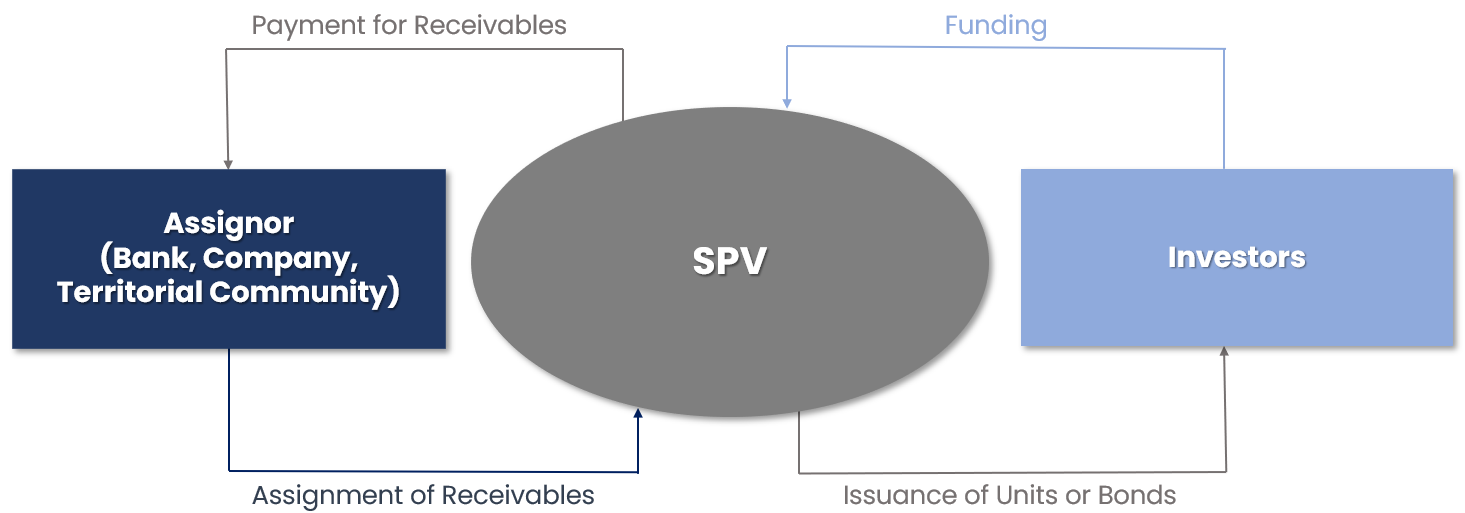

This is organised around a financing vehicle, a specially created legal entity subject to specific

regulations.

This type of financing is based on a simple scheme:

-

First, the arranger analyses the situation as well as the needs and designs the transaction (which securities to issue; how to ensure credit quality, etc.)

-

The assignor (companies, financial institutions or local authorities) assigns receivables to a special purpose vehicle

-

The vehicle finances this acquisition by issuing units or shares; these units or shares are refinanced by a market (listed issue, recourse to a conduit, etc.)

-

As an extension of its role as arranger, Groupe GTI coordinates the drafting of contracts and relations between the various parties.

-

GTI AM, as the management company, ensures the management over time by monitoring compliance with legal and regulatory obligations.

Backed by receivables, the financing reassures investors and supports the issuer. In this way, the seller can diversify its sources of financing, supplementing bank credit or dilutive issues. Moreover, this asset-based financing, not just balance sheet financing, can be adapted to the growth of the seller.