GTI Group, excellence in execution

-

The Group, which is fully owned by the management, is independent of any banking or insurance group. It can work with large groups such as Alstom, Ford or CMA-CGM as well as small and medium-sized companies seeking innovative and secure financing solutions.

-

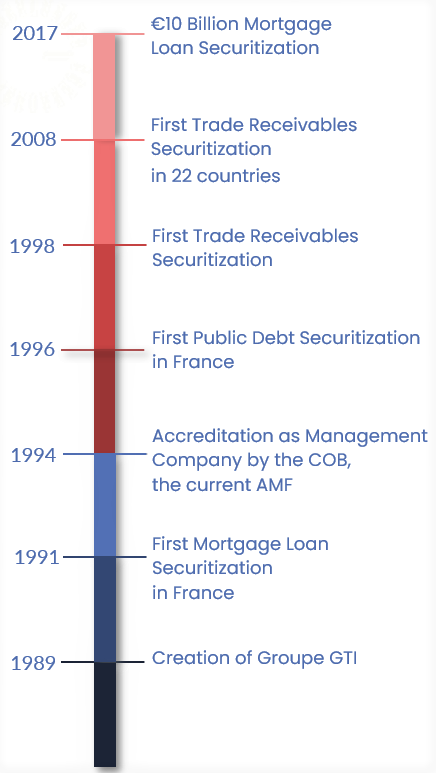

GTI AM, the Group's management company, was initially created with major institutional investors such as Fannie Mae, Crédit Foncier, UAP-AGF and Bayerische Vereinsbank. Since 2000, the Group has been owned by its managers and is totally independent of any banking or insurance group.

-

GTI AM offers innovative and tailor-made financing solutions to its clients, which include SMEs, national and international companies, Fintechs and financial institutions. As a pioneer in securitisation, we are constantly adapting to offer the most appropriate financing solutions for our clients' specific needs. Our know-how combined with our human and technical resources allows us to target the needs of our clients, regardless of their size, structure or sector of activity.